Protecting Your Business: Simply Business Insurance For Peace Of Mind

Understanding Simply Business Insurance: What It Means, How It Works, and How It Can Benefit Your Business

As entrepreneurs and small business owners, we understand the importance of protecting our hard work and investments. In today’s challenging business landscape, it’s crucial to have the right safeguards in place to mitigate potential risks and uncertainties. This is where Simply Business Insurance comes into play – offering comprehensive coverage options tailored to your unique business needs, it ensures your financial security and provides peace of mind.

What does Simply Business Insurance mean?

Simply Business Insurance is a leading provider of commercial insurance designed specifically for small businesses. It offers a wide range of coverage options to protect your business from various risks and liabilities that may arise during day-to-day operations. Whether it’s protection against property damage, accidents, or claims made by third parties, Simply Business Insurance has you covered.

With affordable and flexible coverage options, Simply Business Insurance aims to make securing the right insurance for your business a straightforward and hassle-free process. By understanding the unique challenges faced by small businesses, it provides tailored solutions that address your specific industry needs.

How does Simply Business Insurance work?

Simply Business Insurance works by offering a variety of insurance products designed to meet the diverse needs of small businesses. It starts by assessing the potential risks and liabilities your business may face and then provides you with coverage options that align with your requirements.

Whether you’re a start-up, freelancer, or established entrepreneur, Simply Business Insurance has the expertise to guide you through the insurance process. Their team of experienced professionals will help you understand your coverage options, answer any questions you may have, and provide you with the necessary support to ensure you make informed decisions.

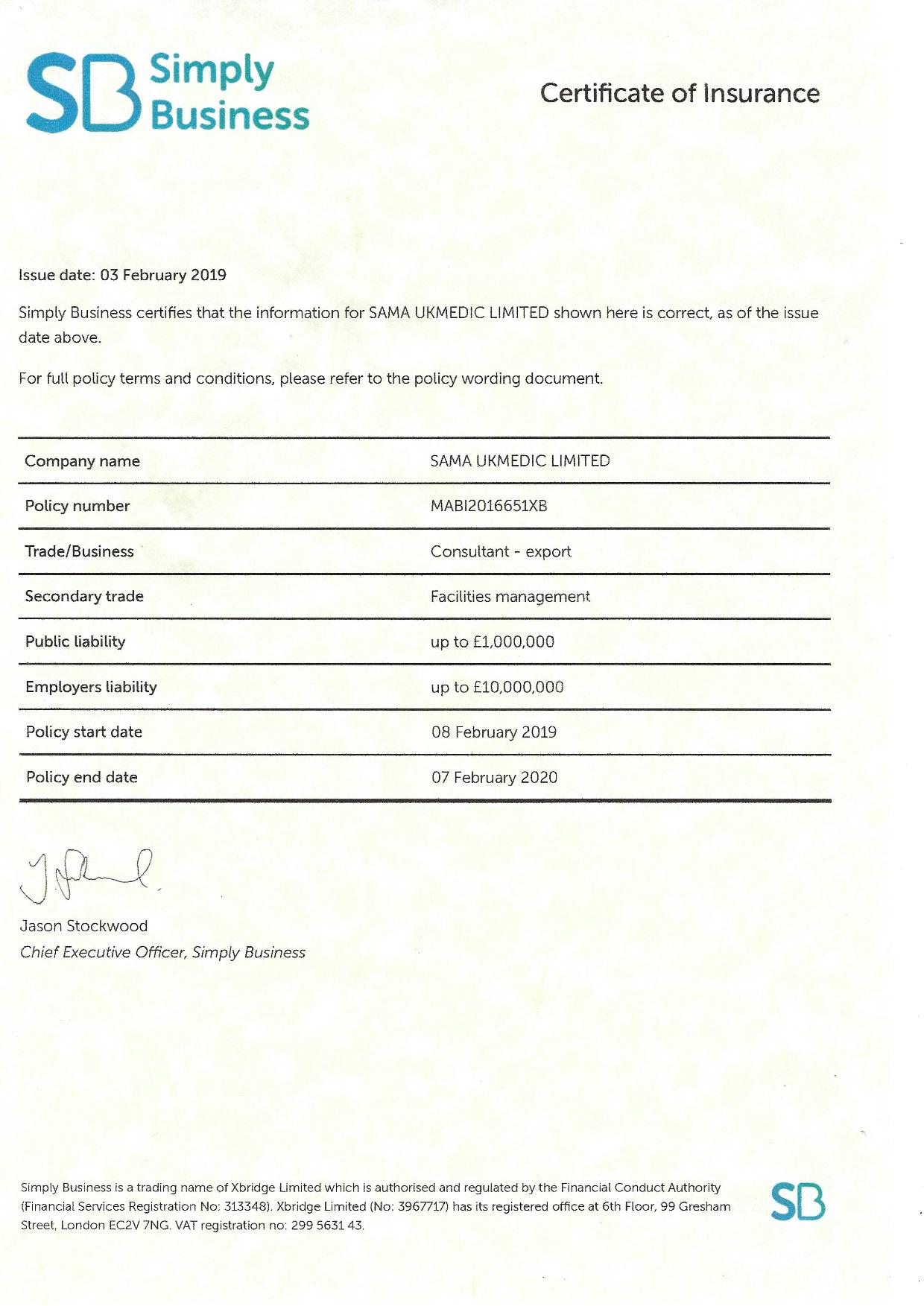

Once you’ve chosen the right coverage for your business, Simply Business Insurance provides you with the necessary policy documents that outline your coverage details, premiums, and any other relevant information. In the event of a claim, their dedicated claims management team will assist you throughout the process, ensuring a smooth and efficient resolution.

What is known about Simply Business Insurance?

Simply Business Insurance is a reputable and trusted insurance provider with a proven track record of serving small businesses across various industries. They understand the unique challenges faced by entrepreneurs and offer comprehensive coverage options tailored to meet their specific needs.

The company has a strong focus on customer satisfaction, providing exceptional service and support to their policyholders. Their team of experts is readily available to address any concerns, answer questions, and provide guidance throughout the insurance process.

Simply Business Insurance has established partnerships with leading insurance carriers, enabling them to offer competitive premiums and extensive coverage options. Their commitment to transparency and integrity ensures that you receive credible and trustworthy insurance solutions.

What are the solutions offered by Simply Business Insurance?

Simply Business Insurance offers a wide range of insurance solutions to cater to the needs of small businesses. Some of the key coverage options include:

1. Professional Indemnity Insurance: This coverage protects your business against claims of professional negligence, errors, or omissions. It provides financial protection in case a client suffers a loss due to your services or advice.

2. Public Liability Insurance: Public Liability Insurance covers your business for any claims made by third parties for injuries or property damage that may occur on your premises or as a result of your business operations.

3. Employer’s Liability Insurance: If you have employees, Employer’s Liability Insurance is a legal requirement in most jurisdictions. It provides coverage for claims made by employees who suffer injury or illness due to their work.

4. Cyber Liability Insurance: In today’s digital age, cyber threats are a significant concern for businesses. Cyber Liability Insurance offers protection against cyber-attacks, data breaches, and other cyber-related risks.

5. Commercial Property Insurance: This coverage protects your physical assets, including buildings, equipment, and inventory, against perils such as fire, theft, or vandalism.

6. Business Interruption Insurance: Business Interruption Insurance safeguards your business against potential income loss and additional expenses resulting from unexpected interruptions to your operations, such as natural disasters or damages to your premises.

These are just a few examples of the coverage options available through Simply Business Insurance. By assessing your business risks and understanding your unique needs, they can recommend the most suitable solutions to protect your business and ensure its continuity.

Why should you consider Simply Business Insurance?

Considering the potential risks and uncertainties associated with running a business, having adequate insurance coverage is essential. Simply Business Insurance offers several compelling reasons why it should be your trusted insurance provider:

1. Tailored Coverage: Simply Business Insurance understands that each business is unique, and their coverage options are tailored to meet your specific needs. This ensures that you only pay for the coverage you require, avoiding unnecessary costs.

2. Expertise and Guidance: Their team of insurance professionals has extensive knowledge and expertise in serving small businesses. Whether you’re a start-up or an established entrepreneur, they provide personalized guidance to help you make informed decisions about your insurance needs.

3. Claims Management: In the unfortunate event of a claim, Simply Business Insurance has a dedicated claims management team that will assist you throughout the process. Their goal is to ensure a smooth and efficient resolution, minimizing any potential disruptions to your business.

4. Competitive Premiums: Simply Business Insurance has established partnerships with leading insurance carriers, allowing them to offer competitive premiums without compromising on coverage quality. This ensures that you receive the best value for your insurance investment.

5. Peace of Mind: By having the right insurance coverage in place, you can focus on growing your business with the peace of mind that comes from knowing you’re protected against potential risks and liabilities.

Conclusion

In conclusion, Simply Business Insurance is a leading provider of comprehensive insurance solutions designed specifically for small businesses. With a focus on tailoring coverage to meet your unique needs, they offer protection against a wide range of risks and liabilities that may arise in your day-to-day operations. By partnering with trusted insurance carriers, they provide competitive premiums without compromising on coverage quality. Simply Business Insurance is committed to ensuring your financial security, offering expertise, guidance, and claims management support throughout the insurance process. Take the necessary steps to protect your business today with Simply Business Insurance.

Frequently Asked Questions (FAQs)

1. How can I obtain a quote for Simply Business Insurance?

To obtain a quote for Simply Business Insurance, you can visit their official website or contact their customer service team. They will guide you through the process and provide you with a personalized quote based on your business needs.

2. Can I customize my Simply Business Insurance coverage?

Yes, Simply Business Insurance offers customizable coverage options to ensure that your policy meets your specific requirements. Their team of experts will work with you to understand your needs and recommend the most suitable coverage for your business.

3. How long does it take to process a claim with Simply Business Insurance?

The processing time for claims with Simply Business Insurance may vary depending on the complexity of the claim. However, their dedicated claims management team strives to ensure a smooth and efficient resolution, minimizing any potential disruptions to your business.

4. Can I add additional coverage to my Simply Business Insurance policy?

Yes, you can add additional coverage options to your Simply Business Insurance policy. Their team will help you assess your needs and recommend any additional coverage that may be beneficial for your business.

5. Is Simply Business Insurance only available for small businesses?

No, while Simply Business Insurance specializes in serving small businesses, they also offer coverage options for larger enterprises. Their team will work with you to understand your business requirements and provide appropriate solutions tailored to your organization’s size and needs.

Post a Comment for "Protecting Your Business: Simply Business Insurance For Peace Of Mind"