Secure Your Nomadic Lifestyle: The Ultimate Guide To Finding The Best Insurance For Digital Nomads

Roaming with Peace of Mind: Safeguarding Your Nomadic Adventure!

Are you a digital nomad, constantly on the move, exploring new horizons, and living life to the fullest? If so, it’s crucial to ensure that you have the right insurance coverage to protect your nomadic lifestyle. In this ultimate guide, we will unravel the secrets to finding the best insurance for digital nomads, providing you with peace of mind as you roam the world!

As a digital nomad, you have the freedom to work from anywhere, but with great freedom comes great responsibility. While traveling can be exhilarating, it’s important to be prepared for any unexpected challenges that may come your way. One of the most significant challenges is ensuring that you have adequate insurance coverage to protect yourself and your belongings while on the go.

When it comes to insurance for digital nomads, there are a few key factors to consider. The first is health insurance. As a nomad, you may find yourself in different countries with varying healthcare systems. It’s essential to have a comprehensive health insurance plan that covers you regardless of your location. Look for a plan that offers worldwide coverage, emergency medical evacuation, and coverage for pre-existing conditions.

Another crucial aspect to consider is travel insurance. While health insurance covers your medical expenses, travel insurance provides coverage for lost baggage, trip cancellations, and delays. This type of insurance ensures that you are protected financially if your belongings are lost or stolen while on your nomadic adventure. Look for a policy that offers high coverage limits and includes coverage for electronics, such as laptops and cameras, which are essential tools for digital nomads.

In addition to health and travel insurance, it’s also important to consider liability insurance. As a digital nomad, you may find yourself working with clients or renting accommodations in various locations. Liability insurance protects you in case of accidents or damages that may occur while you are working or living in a different country. It’s always better to be safe than sorry, and liability insurance ensures that you are protected from any unexpected legal or financial burdens.

When searching for the best insurance for digital nomads, it’s crucial to do thorough research and compare different policies. Look for insurance providers that specialize in coverage for digital nomads, as they will have a better understanding of your unique needs and challenges. Read reviews, ask for recommendations from fellow nomads, and consider reaching out to insurance brokers who can help you find the best policy for your specific situation.

Remember, your nomadic adventure should be filled with excitement and joy, not worry and stress. By securing the right insurance coverage, you can roam the world with peace of mind, knowing that you are protected in case of any unforeseen circumstances. So, don’t let insurance be an afterthought – make it a priority and safeguard your nomadic lifestyle today!

In conclusion, finding the best insurance for digital nomads is essential to secure your nomadic lifestyle. Health insurance, travel insurance, and liability insurance are all key components to consider. By doing thorough research, comparing policies, and seeking advice from insurance experts, you can find the perfect coverage to protect yourself and your belongings while roaming the world. So, embark on your nomadic adventure with peace of mind, knowing that you are fully safeguarded!

Wanderlust Warriors: Unraveling the Secrets to Nomad Insurance Bliss!

Are you a digital nomad, constantly on the go, exploring new horizons, and embracing the freedom of a nomadic lifestyle? If so, you understand the thrill and excitement that comes with this way of life. However, amidst all the wanderlust and adventure, it’s crucial to prioritize your safety and well-being. That’s where nomad insurance comes into play – offering you the ultimate peace of mind while you conquer the world.

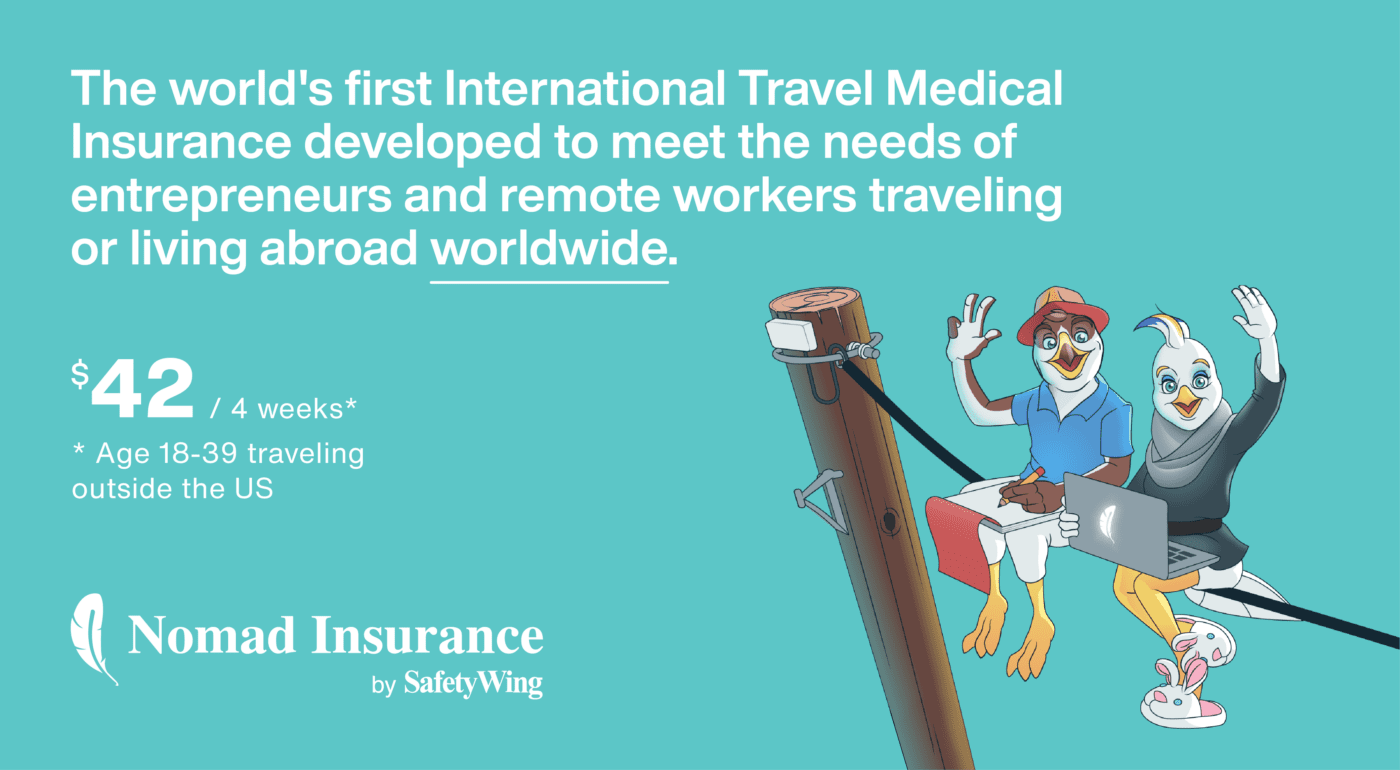

Nomad insurance is specifically designed to cater to the unique needs of digital nomads. Whether you’re working remotely, living out of a suitcase, or hopping from one exotic location to another, this type of insurance provides coverage that traditional policies may not. From medical emergencies to lost belongings, nomad insurance has got your back, allowing you to roam with confidence and tranquility.

Medical coverage is undoubtedly the most critical aspect of nomad insurance. As a digital nomad, you may find yourself in unfamiliar territories, where medical facilities may not be up to par with what you’re used to. This insurance ensures that you receive the necessary medical attention, without putting a dent in your finances. Whether it’s a minor illness or a major accident, nomad insurance covers your medical expenses, giving you the freedom to explore and take risks without worry.

Additionally, nomad insurance often includes coverage for emergency medical evacuation. Imagine being in a remote location and encountering a medical emergency that requires immediate attention. Nomad insurance ensures that you are swiftly transported to the nearest medical facility equipped to handle your condition. With this coverage, you can rest easy knowing that help is just a phone call away, no matter where you are in the world.

But nomad insurance doesn’t limit itself to just medical coverage. It also offers protection for your belongings. As a digital nomad, your laptop, camera, and other tech gadgets are your lifelines. Losing or damaging these items can be a nightmare. Nomad insurance provides coverage for theft, loss, or damage of your valuable possessions, allowing you to replace them and get back on track without any financial burden.

Furthermore, nomad insurance often includes liability coverage. Accidents can happen anywhere, and being liable for someone else’s injury or property damage can quickly turn into a legal and financial nightmare. Nomad insurance takes care of these potential legal expenses, ensuring that you can focus on your nomadic adventures instead of being bogged down by legal proceedings.

Another essential aspect of nomad insurance is trip cancellation coverage. As a digital nomad, your plans are ever-changing, and unexpected circumstances can arise, forcing you to cancel or alter your travel arrangements. Whether it’s due to sudden illness, natural disasters, or any other unforeseen events, nomad insurance reimburses you for any non-refundable expenses, allowing you to reschedule and continue your nomadic journey without incurring significant losses.

In conclusion, nomad insurance is a game-changer for digital nomads. It provides comprehensive coverage, tailored specifically to the needs of a nomadic lifestyle. From medical emergencies to lost belongings, nomad insurance ensures that you can explore the world with peace of mind. So, embrace your wanderlust, be a wanderlust warrior, and unravel the secrets to nomad insurance bliss! Secure your nomadic lifestyle by investing in the best insurance for digital nomads.

Post a Comment for "Secure Your Nomadic Lifestyle: The Ultimate Guide To Finding The Best Insurance For Digital Nomads"