The Ultimate Guide To Commercial Truck Insurance: Everything You Need To Know

Commercial Truck Insurance: Protecting Your Business Assets on the Road

When it comes to running a business that involves the use of commercial trucks, one crucial aspect that must not be overlooked is commercial truck insurance. As owners or operators of these vehicles, we understand the unique risks and challenges associated with the transportation industry. In this article, we will delve into what commercial truck insurance means, how it works, what is known about it, and provide solutions and valuable information to help you navigate this complex field.

What does commercial truck insurance mean?

Commercial truck insurance, also known as trucking insurance or motor carrier insurance, is a specialized type of insurance coverage designed to protect businesses or individuals who own or operate commercial trucks. This insurance provides coverage for various risks associated with the transportation of goods, including accidents, damage to the truck, cargo loss, injuries, and liability claims.

Commercial truck insurance typically covers different types of vehicles, including semi-trucks, tractor-trailers, dump trucks, box trucks, and more. It is essential for businesses that rely on these trucks for their day-to-day operations to have appropriate insurance coverage to safeguard their assets and mitigate potential financial risks.

How does commercial truck insurance work?

Commercial truck insurance works similarly to other types of insurance policies, but with specific provisions tailored to the unique needs of the trucking industry. The coverage and premiums can vary depending on factors such as the type of truck, the cargo being transported, the distance traveled, and the driving records of the operators.

When you purchase commercial truck insurance, you will typically have a range of coverage options to choose from. These options may include liability coverage, physical damage coverage, cargo coverage, uninsured/underinsured motorist coverage, and more. Each coverage type serves a specific purpose to protect your business from different risks you may encounter on the road.

What is known about commercial truck insurance?

Commercial truck insurance is a regulated industry, and the requirements may vary depending on the state and federal laws. To legally operate a commercial truck, businesses are often required to carry a minimum amount of liability insurance to cover potential damages or injuries caused by their vehicles.

Insurance providers specializing in commercial truck insurance take into account several factors when determining premiums and coverage options. These factors include the driving records of the operators, the type of cargo being transported, the vehicle’s value, the radius of operation, and the history of claims made by the business or individuals.

It is important to note that commercial truck insurance policies generally do not cover personal use of the truck or damages that occur outside the scope of business operations. It is crucial to review the policy’s terms and conditions carefully to understand the extent of coverage provided and any exclusions or limitations that may apply.

What are the solutions and information available?

To make informed decisions about commercial truck insurance, it is essential to gather accurate and up-to-date information. The first step is to research and compare different insurance providers that specialize in commercial trucking insurance. Look for reputable companies with expertise in this field and a track record of providing reliable coverage and excellent customer service.

When seeking insurance quotes, be prepared to provide detailed information about your business, the trucks you operate, and the drivers’ records. This information will help the insurance provider assess the risks involved and provide you with accurate quotes tailored to your specific needs.

Consulting with insurance agents who specialize in commercial truck insurance can be immensely helpful. They can guide you through the process, explain the coverage options in detail, and assist you in selecting the most suitable policy for your business.

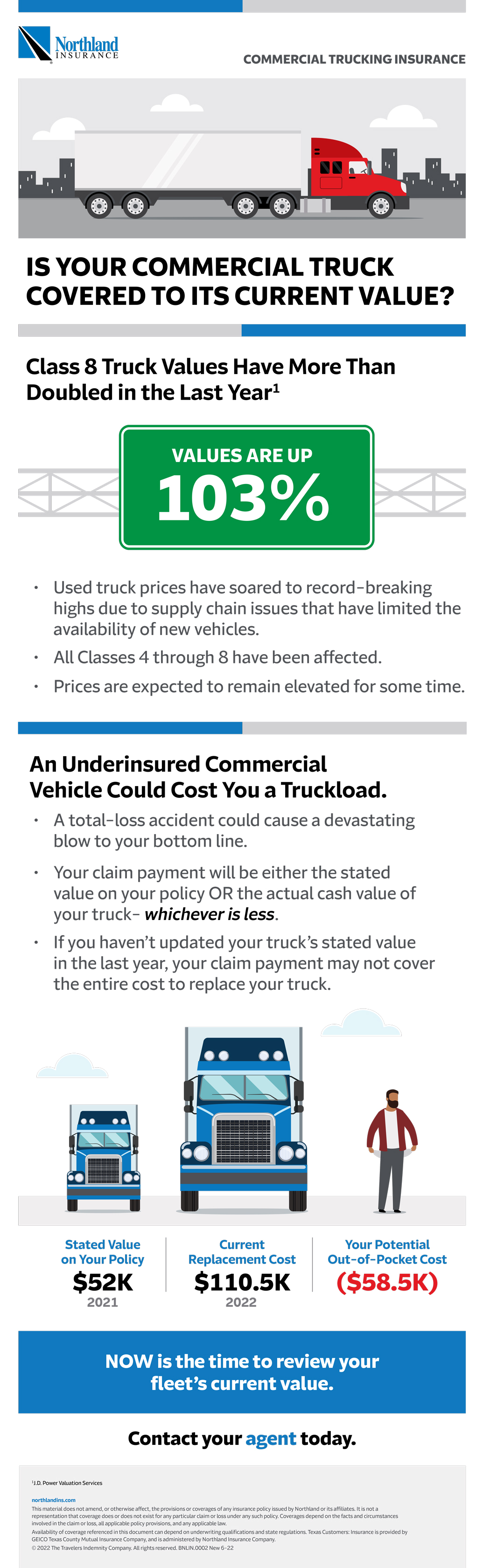

Additionally, it is vital to regularly review and update your commercial truck insurance policy to ensure it aligns with your current business operations. As your business grows or changes, you may need to adjust your coverage to adequately protect your assets and liabilities.

Conclusion

Commercial truck insurance is a crucial aspect of running a business in the transportation industry. By understanding what it means, how it works, and what it covers, you can make informed decisions to protect your business assets and mitigate potential risks. Remember to gather comprehensive information, consult with experts, and regularly review your policy to ensure your coverage remains adequate.

Frequently Asked Questions (FAQs)

1. What factors can affect the cost of commercial truck insurance?

Several factors can influence the cost of commercial truck insurance, including the driving records of the operators, the type of cargo being transported, the vehicle’s value, the radius of operation, and the history of claims made by the business or individuals.

2. Is commercial truck insurance required by law?

In many jurisdictions, commercial truck insurance is legally required to operate commercial trucks. The specific requirements may vary depending on state and federal laws.

3. Can I use my personal auto insurance for my commercial truck?

No, personal auto insurance typically does not cover commercial truck usage. Commercial truck insurance is specifically designed to address the unique risks and liabilities associated with the transportation industry.

4. Can I add additional coverage to my commercial truck insurance policy?

Yes, commercial truck insurance policies often offer various coverage options that can be customized to meet your specific needs. You can add additional coverage types such as physical damage coverage, cargo coverage, or uninsured/underinsured motorist coverage.

5. How often should I review my commercial truck insurance policy?

It is recommended to review your commercial truck insurance policy annually or whenever significant changes occur in your business operations. Regular reviews ensure that your coverage remains adequate and up-to-date.

Post a Comment for "The Ultimate Guide To Commercial Truck Insurance: Everything You Need To Know"