The Importance Of Comparing Term Life Insurance Quotes For Affordable Coverage

Understanding Term Life Insurance Quotes

What does it mean?

Term life insurance quotes refer to the estimated costs provided by insurance companies for purchasing a term life insurance policy. Term life insurance is a type of life insurance that provides coverage for a specific period, usually ranging from 10 to 30 years. These quotes offer individuals an idea of how much they can expect to pay for a particular amount of coverage during the chosen term.

How do term life insurance quotes work?

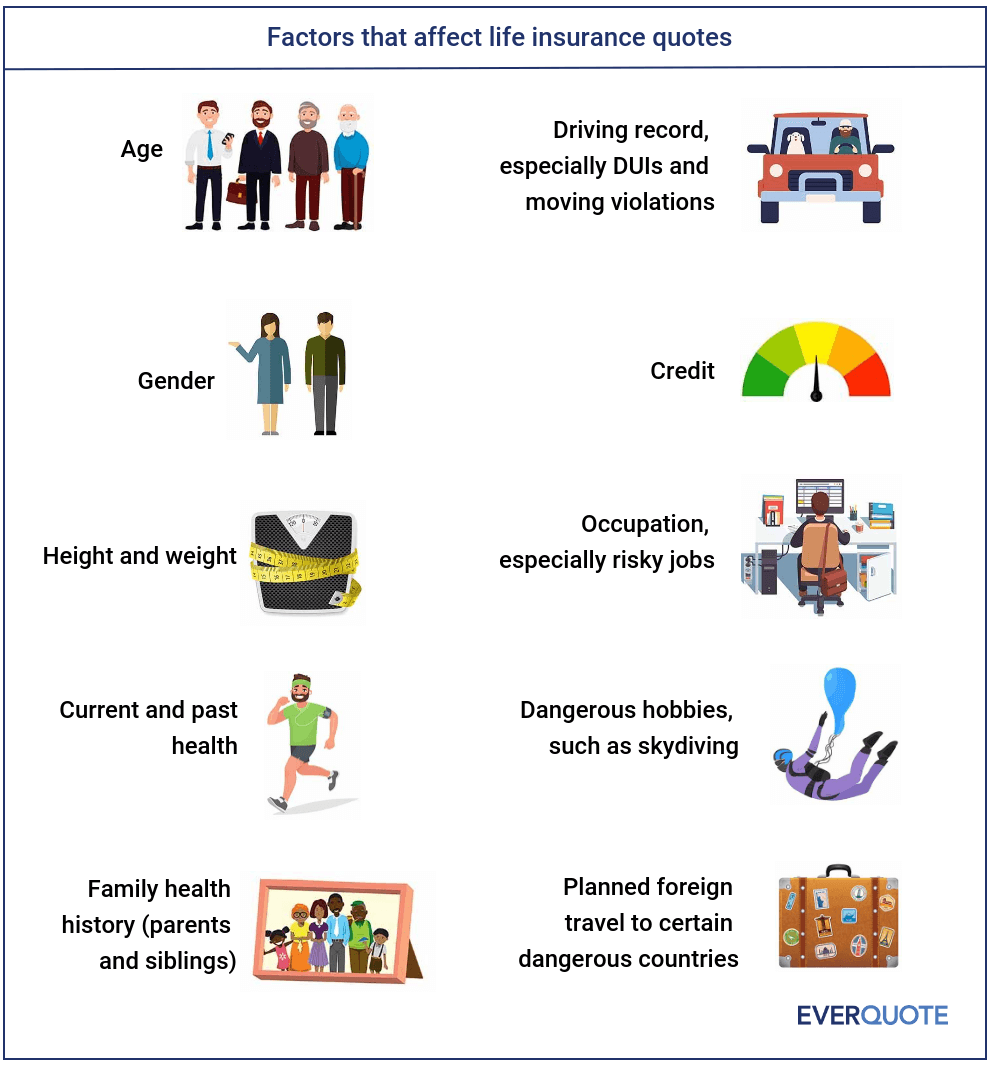

When individuals request term life insurance quotes, they provide information about their age, gender, health status, desired coverage amount, and the term length they prefer. Insurance companies then use this information, along with their actuarial models and underwriting guidelines, to calculate the estimated cost of the policy. These quotes can be obtained through various channels, such as online insurance marketplaces, insurance agents, or directly from insurance company websites.

What is known about term life insurance quotes?

Term life insurance quotes are based on several key factors, including the individual’s age, gender, health condition, smoking status, and the desired coverage amount. Younger and healthier individuals typically receive lower quotes as they are considered lower risk by insurance companies. Moreover, individuals who do not smoke generally receive more favorable quotes compared to smokers. The coverage amount chosen also plays a significant role in determining the cost, as higher coverage amounts result in higher premiums.

It is important to note that term life insurance quotes provide estimated costs and are subject to change based on the results of the insurance application process. Once individuals decide to proceed with a policy, they are required to complete an application, undergo medical underwriting, and potentially provide additional information or medical tests. The final premium may differ from the initial quote if any new information arises during the underwriting process.

Solution

Obtaining multiple term life insurance quotes is crucial to ensure individuals find the best coverage at the most affordable price. Comparing quotes from different insurance companies allows individuals to evaluate the options available to them and make an informed decision. It is recommended to gather quotes from at least three reputable insurance providers to obtain a comprehensive view of the market.

Additionally, it is essential to review the terms and conditions, coverage limits, exclusions, and any additional riders or benefits offered by each policy. By carefully considering all these factors, individuals can select the most suitable term life insurance policy that meets their financial needs and provides adequate protection for their loved ones in the event of their passing.

Information about term life insurance quotes

When requesting term life insurance quotes, it is essential to provide accurate and honest information about personal details, health history, and lifestyle choices. Inaccurate or incomplete information can lead to discrepancies between the initial quote and the final premium, potentially causing delays, policy changes, or even policy cancellations.

Furthermore, term life insurance quotes may vary depending on the insurance company’s underwriting guidelines and risk assessment methods. While some companies may specialize in providing affordable coverage for individuals with certain health conditions or lifestyles, others may have stricter underwriting criteria. It is vital to explore different insurance providers to find the one that offers the most favorable terms considering individual circumstances.

Conclusion

Term life insurance quotes play a vital role in helping individuals make informed decisions when purchasing life insurance coverage. By obtaining multiple quotes and comparing them based on coverage amount, term length, and premium costs, individuals can find the most suitable policy for their needs. However, it is crucial to be truthful and accurate when providing information during the quote request process to ensure that the final premium aligns with the initial quote. Remember, term life insurance offers financial protection for loved ones and can provide peace of mind during uncertain times.

Frequently Asked Questions (FAQs)

1. Can I trust the term life insurance quotes I receive online?

Yes, reputable online insurance marketplaces and insurance company websites provide reliable term life insurance quotes. However, it is important to provide accurate information and consider that these quotes are estimates and subject to change based on the final underwriting process.

2. How can I lower my term life insurance quotes?

Several factors influence term life insurance quotes, including age, health, and lifestyle choices. To potentially lower your quotes, consider maintaining a healthy lifestyle, quitting smoking if applicable, and choosing a shorter term length or a lower coverage amount.

3. Are term life insurance quotes the same for everyone?

No, term life insurance quotes vary depending on individual factors such as age, gender, health condition, and lifestyle choices. Younger, healthier individuals typically receive lower quotes compared to older individuals or those with certain health conditions.

4. Can I change my term life insurance policy after receiving a quote?

Yes, you can make changes to your term life insurance policy after receiving a quote. However, any changes may affect the final premium. It is crucial to review and understand the policy terms before making any modifications.

5. How often should I review my term life insurance coverage?

It is recommended to review your term life insurance coverage periodically or when significant life events occur, such as marriage, having children, or changes in financial circumstances. Ensuring your coverage aligns with your current needs and responsibilities is essential to have adequate protection.

Post a Comment for "The Importance Of Comparing Term Life Insurance Quotes For Affordable Coverage"